[ad_1]

The CMOS image sensor market grew at a record 20% y-oy in 2017,matching the growth of the overall semiconductor market, reports Yole Développement.

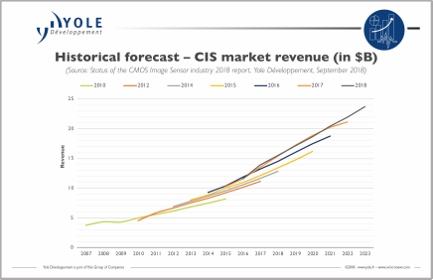

The CIS market was worth $13.9 billion last year and will have a 9.4% CAGR between 2017 and 201, says Yole.

The main driver is smartphones integrating additional cameras to support functionalities like optical zoom, biometry, and 3D interactions.

The YoY growth in the CIS market hit a peak at last year atb20% due to the exceptional increase in image sensor value, across almost all markets, but primarily in the mobile sector.

Revenue is dominated by mobile, consumer, and computing, which represent 85% of total 2017 CIS revenue. Mobile alone represents 69%. Security is the second-largest segment, behind automotive.

The CIS ecosystem is currently dominated by the three Asian heavyweights: Sony, Samsung, and Omnivision. Europe made a noticeable comeback. Meanwhile, the US maintains a presence in the high-end sector.

The market has benefited from the operational recovery of leading CIS player Sony, which captured 42% market share.

‘Apple iPhone has had a tremendous effect on the semiconductor industry, and on imaging in particular. It offered an opportunity for its main supplier, Sony, to reach new highs in the CIS process, building on its early advances in high-end digital photography”, says Yole’s Pierre Cambou.

CIS has become a key segment of the broader semiconductor industry, featuring in the strategy of most key players, and particularly the industry leader Samsung.

Mobile, security and automotive markets are all in the middle of booming expansion, mostly benefiting ON Semiconductor and Omnivision.

These markets are boosting the players that are able to keep up with technology and capacity development through capital expenditure.

The opportunities are all across the board, with new players able to climb the rankings, such as STMicroelectronics and Smartsense.

Technology advancement and the switch from imaging to sensing is fostering innovation at multiple levels: pixel, chip, wafer, all the way to the system.

[ad_2]

Source link