[ad_1]

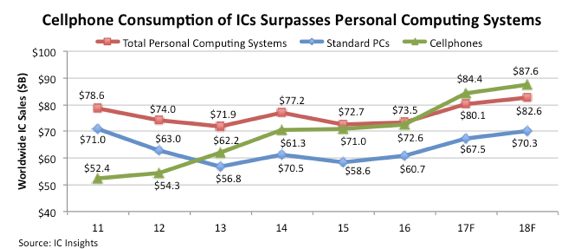

IC sales for handsets are projected to grow 16% in 2017 to $84.4 billion, as shown in Figure 1, while the IC market for personal computing systems (desktop and notebook PCs, tablets, and thin-client Internet-centric units) is now forecast to increase 9% to $80.1 billion this year.

Figure 1

IC sales for both cellphones and total personal computing systems are strengthening significantly in 2017 primarily because of strong increases in the amount of money being spent on memory, with the average selling price (ASP) of DRAM expected to climb 53% and NAND flash ASP forecast to rise 28% this year.

In 2016, IC sales for cellphone handsets grew 2% after rising 1% in 2015, while dollar volume for integrated circuits used in personal computing systems increased just 1% last year after falling 6% in 2015.

Cellphone IC sales are also getting a lift from a projected 5% increase in shipments of smartphones, which are being packed with more low-power DRAM and nonvolatile flash storage, while growth in personal computing is expected to be held back by 3% declines in both standard personal computer and tablet unit volumes in 2017.

Shrinking shipments of desktop and notebook computers enabled cellphone IC sales to surpass integrated circuit revenues for standard PCs in 2013.

During 2015 and 2016, cellphone IC sales came close to catching up with integrated circuit sales for total personal computing systems. In 2017, cellular phone handsets are now forecast to take over as the largest end-use systems category for IC sales.

The gap between IC sales for cellphones and total personal computing systems is projected to widen by the end of this decade. Cellphone integrated circuit sales are expected to increase by a compound annual growth average (CAGR) of 5.3% in the 2015-2020 forecast period to $92.1 billion versus personal computing IC revenues rising by CAGR of just 2.9% to $83.8 billion in 2020, says IC Insights.

The refreshed forecast shows IC sales for standard PCs climbing 11.2% in 2017 to $67.5 billion after increasing about 4% in 2016 to $60.7 billion.

Tablet IC sales are now expected to drop 2% to $11.8 billion in 2017 after falling 11% in 2016 to $12.1 billion, based on the updated outlook.

IC sales for thin-client and Internet/cloud computing centric systems—such as laptops based on Google’s Chromebook platform design—are projected to rise 15% in 2017 to a $838 million after surging 21% in 2016 to $728 million.

Between 2015 and 2020, IC sales for standard PCs are expected to grow by a CAGR of 4.1% to $71.6 billion in the final year of the updated outlook, while table integrated circuit revenues are projected to fall by -3.9% annual rate in the period to about $11.0 billion and ICs in Internet/cloud computing are forecast to rise by CAGR of 13.8% to more than $1.1 billion.

[ad_2]

Source link