[ad_1]

Memory, specifically DRAM and NAND flash, is the major market driver. WSTS projects the memory market will grow 60% in 2017, while the semiconductor market excluding memory will increase 9%. Memory was 23% of the semiconductor market in 2016 but accounts for two-thirds of the $70 billion change in the 2017 semiconductor market versus 2016.

The market for PCs and tablets has been weak, with declines in 2016 and 2017. Gartner expects a slight improvement in 2018 to a roughly flat market at 0.2% change.

IDC believes smartphone unit growth will accelerate from 1.4% in 2017 to 3.7% in 2018.

IC Insights projects ICs for automotive and Internet of things (IoT) applications will be key market drivers over the next few years. These two categories should each show robust increases of 16% in 2018L

The IMF October 2017 economic outlook called for global GDP to rise 3.6% in 2017, an acceleration of 0.4 percentage points from 3.2% in 2016. 2018 is expected to show a slight acceleration to 3.7% growth. Advanced economies are projected to decelerate from 2.2% GDP change in 2017 to 2.0% in 2018.

Among the advanced economies, an acceleration in U.S. GDP growth is more than offset by slower increases in the Euro area, UK and Japan.

The acceleration in global GDP in 2018 will be driven by emerging and developing economies, moving from a 4.6% change in 2017 to 4.9% in 2018. A deceleration in China from 6.8% in 2017 to 6.5% in 2018 is more than offset by accelerating change in India, steady growth in the ASEAN-5 (Indonesia, Malaysia, Philippines, Thailand and Vietnam), and a continuing recovery in Latin America.

In the last 25 years, there have been four cycles where the memory market has shown at least one year of growth over 40%. These cycles usually ended with a major decline the memory market, ranging from 13% to 49%. The exception was 2004-2005, when the memory market went from 45% growth to a modest 3% change.

The upside of the memory cycles generally lasted two to four years. The exception to this was 2010, where a 55% memory increase was preceded by a 3% decline in 2009 and followed by a 13% decline in 2011. Based on this history, we will most likely see one more year of solid memory growth in 2018 before a decline in 2019.

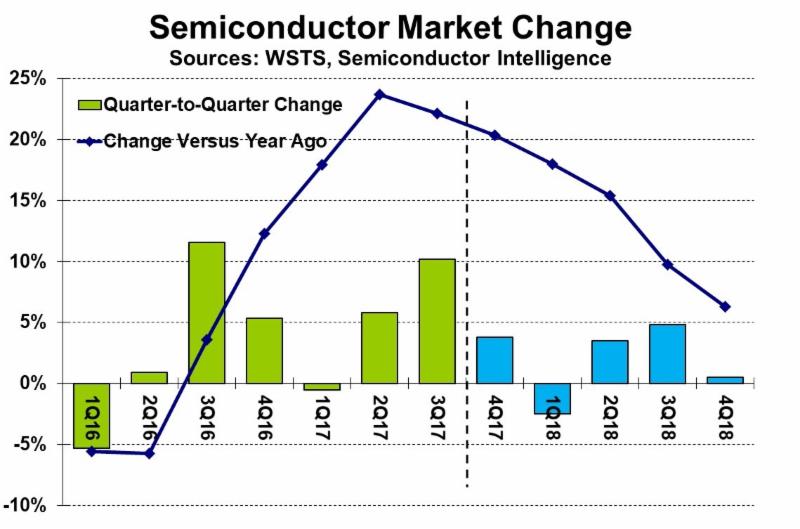

The 2017 semiconductor market has exhibited robust gains in each quarter versus a year ago, starting at 18% in 1Q 2017 and peaking at 24% in 2Q 2017. 3Q 2017 grew 22% from a year ago and 10.2% versus the prior quarter. 3Q 2017 was only the second double-digit quarter-to-quarter increase in the last eight years (after 11.6% in 3Q 2016).

This quarterly pattern will drive healthy year 2018 growth with only modest quarter-to-quarter change in each quarter of 2018 for annual growth 12%.

[ad_2]

Source link