[ad_1]

“PC DRAM prices set by the top three suppliers in January were on average $33, showing a 5% increase from the previous month,” says Avril Wu, research director of DRAMeXchange.

In the server DRAM market, the demand comes from Google, Microsoft Facebook snd Apple as they buy servers for their data centres.

DRAMeXchange estimates that prices of server DRAM products will go up by 3-5% QoQ in 1Q18.

In the mobile DRAM market, demand is being affected by weaker-than-expected smartphone sales and sliding NAND Flash prices.

Furthermore, China’s National Development and Reform Commission has intervened against further DRAM price hikes.

As a result, the price upswing in the mobile DRAM market has moderated. The latest analysis puts QoQ increase in the ASP of mobile DRAM at 3% for 1Q18. DRAMeXchange expects the overall revenue to increase further by more than 30% in 2018, reaching US$96 billion.

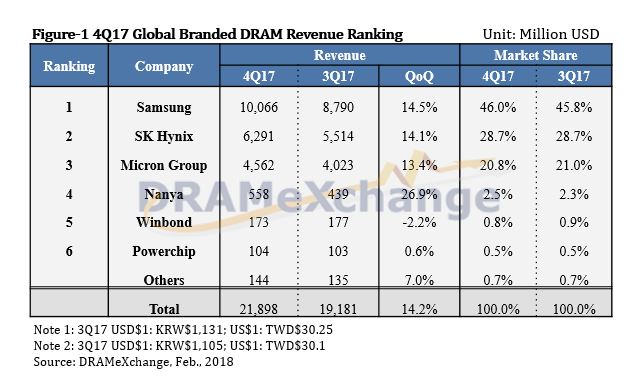

In the 4Q17 revenue ranking, Samsung was still the leader and again achieved a new record high. With a quarterly total of US$10.1 billion in DRAM revenue, Samsung registered a growth of 14.5% from 3Q17.

Hynix and Micron were also in 2nd and 3rd place, respectively. Hynix’s revenue for 4Q17 increased by 14.1% QoQ to US$6.3 billion.

The two Korean memory suppliers have a combined market share of 74.7% of the global DRAM market in 4Q17 (i.e. Samsung at 46% and SK Hynix at 28.7%).

Micron’s DRAM revenue for 4Q17 totalled $4.6 billion, translating to a 13.4% QoQ increase and a global market share of 20.8%.

In operating margins, Samsung led with 64% followed by zhynix with 59% followed by Micron with 56%.

[ad_2]

Source link