[ad_1]

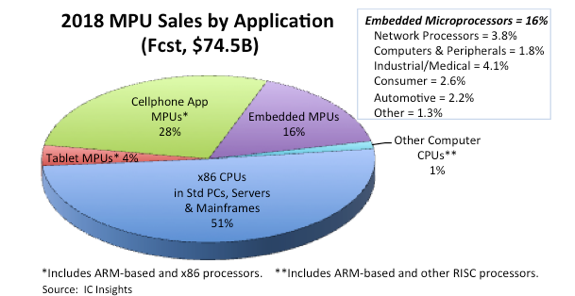

IC Insights’ McClean Report 2018 forecasts that 52% of 2018 MPU sales will come from sales of all types of microprocessors used as CPUs in standard PCs, servers, and large computers.

Only about 16% of MPU sales are expected from embedded applications in 2018, with the rest coming from mobile application processors used in tablets (4%) and cellphones (28%).

Cellphone and tablet MPUs exclude baseband processors, which handle modem transmissions in cellular networks and are counted in the wireless communications segment of the special-purpose logic IC product category.

A little over half of 2018 microprocessor sales are expected to come from x86 MPUs for computer CPUs sold by Intel and rival Advanced Micro Devices.

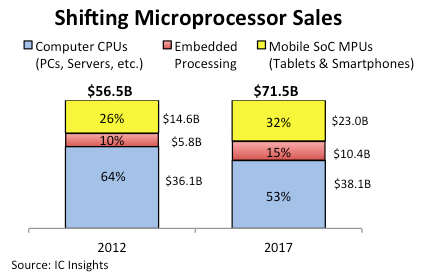

Cellphone and tablet SoC processors were the main growth drivers in microprocessors during the first half of this decade, but slowdowns have hit both of these MPU categories since 2015.

Market saturation and the maturing of the smartphone segment have stalled unit growth in cellular handsets. Cellphone application processor shipments were flat in 2016 and 2017 and are forecast to rise just 0.3% in 2018 to reach a record high of nearly 1.8 billion units in the year.

The microprocessor business continues to be dominated by the world’s largest IC maker, Intel (Samsung was the world’s largest semiconductor supplier in 2017).

Intel’s share of total MPU sales had been more than 75% during most of the last decade, but that percentage is now slightly less than 60% because of stronger growth in cellphones and tablets that contain ARM-based SoC processors.

For nearly 20 years, Intel’s huge MPU business for personal computers has primarily competed with just one other major x86 processor supplier—AMD—but increases in the use of smartphones and tablets to access the Internet for a variety of applications has caused a paradigm shift in personal computing, which is often characterized as the “Post-PC era.”

This year, AMD looks to continue its aggressive comeback effort in x86-based server processors that it started in 2017 with the rollout of highly parallel MPUs built with the company’s new Zen microarchitecture.

Intel has responded by increasing the number of 64-bit x86 CPUs in its Xeon processors. Intel, AMD, Nvidia, Qualcomm, and others are also increasing emphasis of processors and co-processor accelerators for machine-learning AI in servers, personal computing platforms, smartphones and embedded processing.

The 2018 McClean Report shows that the total MPU market is forecast to rise 4% to $74.5 billion in 2018, following market growth of 5% in 2017 and 9% in 2016.

Through 2022, total MPU sales are expected to increase at a CAGR of 3.4%.

Total microprocessor units are expected to rise 2% in 2018, the same growth rate as 2017, to 2.6 billion units.

Through the forecast period, total MPU units are forecast to rise by a CAGR of 2.1%.

[ad_2]

Source link