[ad_1]

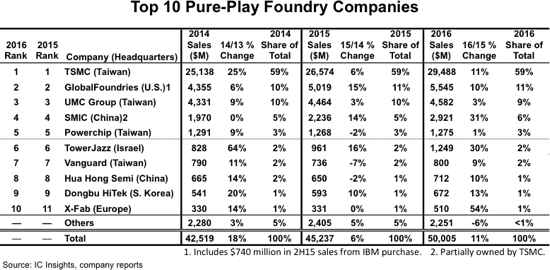

Figure 1 shows the ranking of the top 10 pure-play foundries in 2016.

In 2016, the “Big 4” pure-play foundries (i.e., TSMC, GlobalFoundries, UMC, and SMIC) held an 85% share of the total worldwide pure-play IC foundry market.

As shown, TSMC held a 59% marketshare in 2016, the same as in 2015, and its sales increased by $2.9 billion last year, more than double the $1.4 billion increase it logged in 2015. GlobalFoundries, UMC, and SMIC’s combined share was 26% in 2016, the same as in 2015.

The three top-10 pure-play foundry companies that displayed the highest growth rates in 2016 were X Fab (54%), which specializes in analog, mixed-signal, and high-voltage devices and acquired pure-play foundry Altis in 3Q16 to move into the top 10 for the first time, China-based SMIC (31%), and analog and mixed-signal specialist foundry TowerJazz (30%), whilev

TowerJazz went from $505 million in sales in 2013 to $1,249 million in 2016 (a 35% CAGR)

SMIC more than doubled its revenue from 2011 ($1,220 million) to 2016 ($2,921 million) and registered a 19% CAGR over this five-year timeperiod.

Seven of the top 10 pure-play foundries listed in Figure 1 are based in the Asia-Pacific region. Europe-headquartered specialty foundry X-Fab, Israel-based TowerJazz, and U.S.-headquartered GlobalFoundries are the only non-Asia-Pacific companies in the top 10 group.

[ad_2]

Source link