[ad_1]

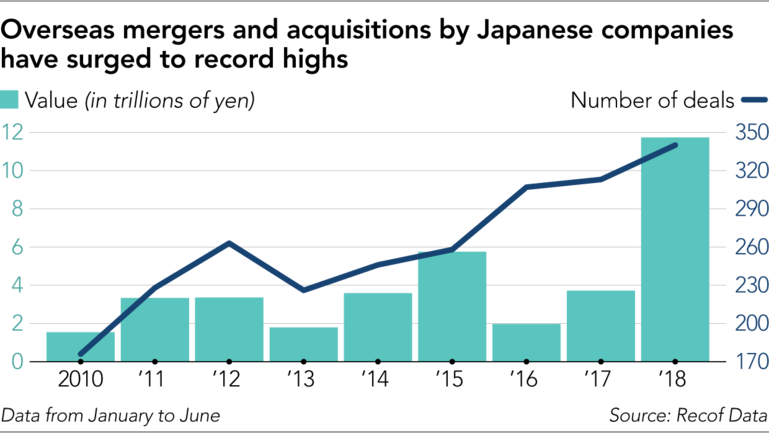

So major, in fact, that it shelled out $106 billion on 340 deals in the first half of the year, says Recof Data, 3x more in value than in H1 2017.

The biggest deal in H1 was Takeda Pharma buying Shire of Ireland for $63 billion.

Among 1,798 deals in H1, Toyota invested in Grab, Softbank invested in Uber, Sony invested in EMI Music, and Recruit Holdings bought Glassdoor.

It is happening as traditional Japanese industry has been in dire trouble: the display industry forced to consolidate and seek a bail-out, Renesas bailed out by the state, Sharp sold to Taiwan, and Toshiba going through agonies to raise the cash to stay alive.

[ad_2]

Source link