[ad_1]

Although the semiconductor industry was flat in terms of revenues, the Philadelphia SOX is up 34% on the year from 88 in January to 124 yesterday.

The SOX has been driven by continued M&A, continued growth in data centres and increasing demand for automotive ICs as cars get increasingly automated and connected.

Other potential drivers like IoT, AI, VR, AR and wearables have yet to kick in.

China’s increasingly expensive and extensive moves to get into the chip industry to relieve its huge trade deficit in ICs is a major boost for manufacturing equipment vendors. Of the 62 new fabs due to come on-line in the world between 2017 and 2020, 26 will be in China, representing 42% of the world total.

M&A in 2016 was only half what it was in the $100 billion year of 2015, but it would have been much higher if China had been allowed to buy more US and Taiwanese semiconductor companies.

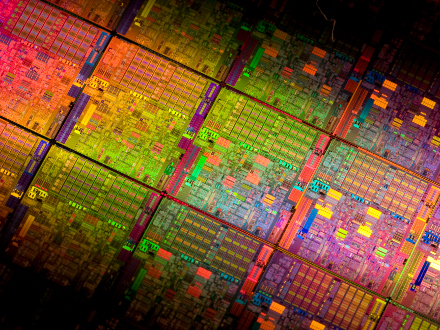

Process, as always, continues to drive the industry. Although Intel, TSMC and Samsung are reported to be having difficulties with 10nm, that is only to be expected at this stage of the node. The important thing is they are still offering performance improvements to SoC designers with upcoming 7nm and 5nm processes and that means systems houses will continue to buy chips.

Semiconductor market forecasts for 2017 range from growth of 3.3% (WSTS) to 8% growth (Semiconductor Intelligence).

The memory market will grow 10% next year, says IC Insights, and will be worth $85.3 billion as a result of ASP rises in DRAM and NAND. Starting in 2017, increases in the memory market are forecast to continue for four years with sales topping $100 billion for the first time in 2020 and then reaching nearly $110.0 billion in 2021.

5G could become a fantastic catalyst for the whole tech sector if operators can, somehow, be persuaded to put in the capacity to deliver extensive, genuine, 10Gbps+, 5G performance. 4G was only used to relieve congestion giving only very few people a genuine 4G performance level.

With the US, EU, China and Korean authorities all very keen to have genuine 5G capabilities in their regions, because they will enable things like driverless cars, then there is some hope that governments and operators will combine to make genuine 5G a reality.

[ad_2]

Source link