[ad_1]

This is the conclusion of a report by CB Insights.

At the moment the UK is the best place in Europe for start-ups.

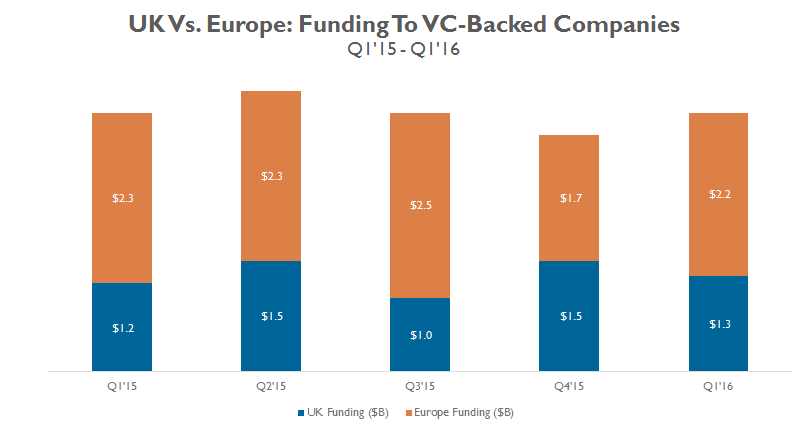

In terms of dollar funding, in Q1’16, UK-based VC-backed companies drew $1.3 billion in funding compared to $2.2 billion for companies elsewhere in Europe.

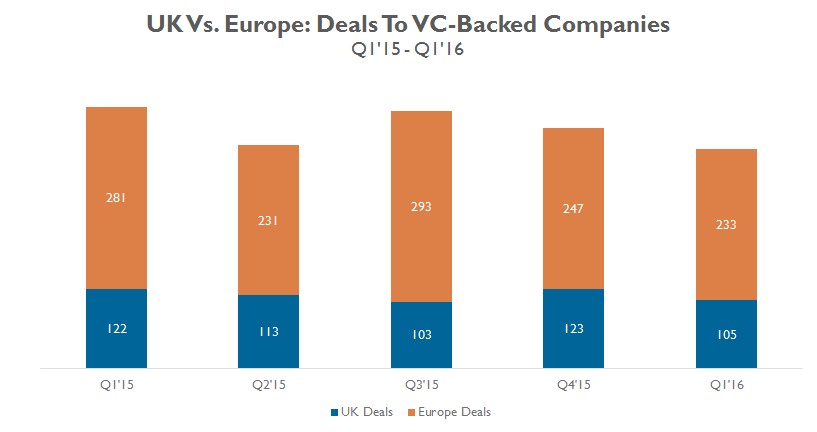

In the last couple of quarters, one-third of deals to VC-backed companies in Europe have gone to startups in the UK.

One of the more significant investors in VC funds in Europe is the EU-backed European Investment Fund (EIF) which is expected to reduce UK-based VC investment.

“The biggest investor in venture capital in Europe is the EIF, and if they scale back investment, that could have an extraordinarily cataclysmic effect on the industry,” Tim Levene a founder of London-based VC firm Augmentum Capital, told CNBC.

The other problem is a brain drain. ‘The free movement of workers between the UK and the EU arguably made London into the top tech start-up talent pool in all of Europe,’ says the report, ‘the decision to leave the EU may cause a brain drain that could hamstring innovation in London’.

Adopting the Australian-style points system is seen as too laborious and slow for small companies.

Suddenly, it is being said, UK-based software talent is looking poachable.

[ad_2]

Source link